Here are the details: this is why the Hungarian industry collapsed again

On an annual basis, one of the most important sectors of the Hungarian economy recorded the biggest decline of the year so far in August. Industrial production suffered a double-digit decline, KSH also came out with the details. The government links the weakness of Hungarian industry to the poor performance of the German economy. At the same time, analysts believe that the output of domestic industry has been stagnating or slightly decreasing for two years, and due to the weak outlook, it holds a negative surprise for the Hungarian economy as a whole.

9.5, adjusted for the effect of working days, the volume of industrial production in August 2024 was 4.1 percent lower than a year earlier – the Central Statistical Office maintained its first data in its second estimate. KSH claims that the two less working days this month than in August 2023 are the reason for the notable discrepancy when compared to the raw data. As for the monthly change: based on seasonally and working day-adjusted data, industrial output decreased by 0.5 percent compared to July.

Here are the details

Among the manufacturing industry sub-sectors, production increased in three and fell in ten:

The amount of industrial exports was 6.3% less than the previous year. Vehicle exports, which made up 30 percent of manufacturing export sales, decreased by 14.0 percent, while electrical equipment output, which made up 15 percent, decreased by 11.3 percent.

In comparison to the same month last year, the manufacturing sector’s domestic sales fell by 10.6 percent and the industry’s by 7.3 percent.

The production of the processing industry, which represents a decisive weight within the industry (94 percent) , was 10.2 percent lower, while at the same time, the output of the minor mining industry was 10.6 percent, and that of the energy industry (electricity, gas, steam supply, air conditioning) was 6.2 percent higher.

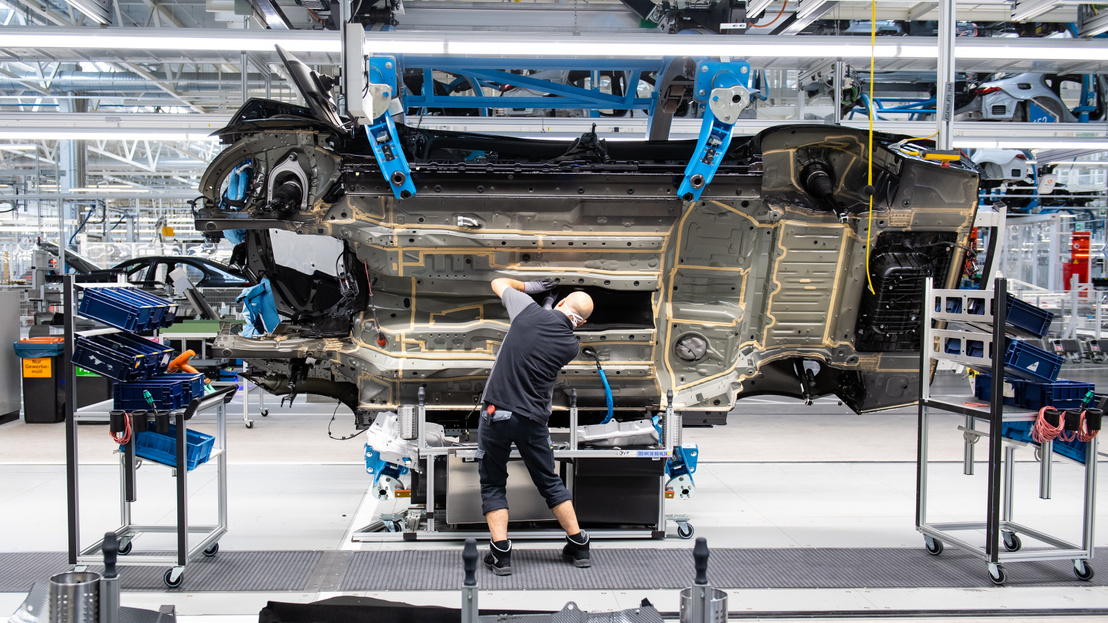

The volume of vehicle production, which has the largest weight and represents 23 percent of manufacturing production, fell by 12.4 percent compared to the same month of the previous year. Both the output of road vehicles and their component parts fell by 16.5 and 8.8 percent, respectively.

The production of electrical equipment, which accounted for 11 percent of the manufacturing industry, was 15.7 percent lower than a year earlier. The two most important subsectors saw a 24.0 percent decline in battery and dry cell production and a 15.0 percent decline in electric motor, power generator, distribution, and control device manufacturing.

The production of computer, electronic and optical products, which accounted for 9.8 percent of manufacturing production, was 13.2 percent lower than in August 2023. Among the two largest sub-sectors, the production of electronic components and circuit boards decreased by 19.7 percent, and the production of computers and peripheral units by 0.4 percent.

After the expansion of the previous month, the production of food, beverages and tobacco products, which benefited from the manufacturing industry by 16 percent, decreased by 0.2 percent compared to the same month of the previous year, which is the result of the increase in domestic sales and the decrease in exports. Meat processing, preservation, and the production of meat products, representing the largest weight (22 percent), increased by 5.6 percent compared to August of the previous year. Production also increased in five sub-sectors, between 6.2 and 24 percent, the strongest in the production of mill products and starch, the least in milk processing. In the other five sub-sectors, emissions decreased by between 1.2 and 23 percent, mostly in fruit and vegetable processing and preservation.

Of the two medium-weight sub-sectors, the production of rubber, plastic and non-metallic mineral products was 5.3 percent lower than in the same period of the previous year, and the production of metal raw materials and metal processing products was 20 percent lower.

Growth continued in the production of chemical substances and products, which accounted for 4.8 percent, and in August output increased by 5.3 percent compared to the low base of a year earlier.

Among the sub-sectors, the output of the lower-weight coke production and petroleum processing fell the most, by 24 percent, sales decreased in both sales directions.

Must Visit:

Talking about work at home, pros and cons

13 SEO Tricks to Improve your Ranking on Google

The Impact of Leather Fashion Products on Sustainable Fashion Trends

The number of orders is also not encouraging

Industrial production decreased in all regions of Hungary compared to the same month of the previous year: the largest, by 14.7 percent, in the Pest region, and the least, by 3.8 percent, in South Transdanubia.

The volume of all new orders in the observed manufacturing sectors fell by 10.9 percent compared to August 2023. New domestic orders fell by 14.5 percent and new export orders by 10.2 percent. The total order backlog at the end of August was 26 percent lower than a year earlier.

The balance of the first eight months

Regarding the performance of the year so far:

Industrial production decreased by 3.8 percent in January-August 2024 compared to the same period of the previous year.

The volume of foreign market sales, which accounted for 62 percent of all sales, decreased by 4.6 percent, and that of domestic sales, which represented 38 percent, decreased by 2.9 percent.

Production fell in nine of the thirteen sub-sectors of the manufacturing industry, the biggest drop being in the production of electrical equipment by 12.6 percent. The output of the largest sub-sector, vehicle manufacturing, decreased by 7.5 percent. The volume of production stagnated in one sub-sector and increased in three, between 1.6 and 5.5 percent, mostly in the production of food, beverages and tobacco products.

The desire for recovery without a breeding ground

As we wrote in the first estimate : according to the government, the weakness of the German industry is dragging the Hungarians along, while according to analysts, overall negative processes are taking place in the drag industry from the point of view of the domestic economy.

“The output of domestic industry has been stagnating or slightly decreasing for two years. For the time being, there are no factors in the field of core processes that would represent an upward risk for the rest of the year. The plant closures and ventilated, large-scale downsizing of the German manufacturers – for the time being abroad – are only now coming. In the medium term, we can be optimistic: the significant capacity expansions coming into production – mainly in the vehicle industry and in the field of battery production – may result in a substantial recovery of output, in larger volumes starting from the second half of next year. However, there is a great deal of uncertainty: the question is whether the lack of demand experienced in the recent period will lead to the postponement of projects or whether it will delay the start-up of production,” explained János Nagy, Erste Bank’s macroeconomic analyst.

“The fact that the Hungarian industry avoided a significant summer correction this year is undoubtedly promising, since the half-percent decline is not catastrophic. Although it could easily be that the low level of this correction indicates just how weak the basic processes are in the traction sectors, the shutdown of which usually causes a serious loss due to the large production volume. Now, however, the performance of these sectors is already weak. As a result of the low base a year earlier, the calendar-adjusted figure shows a 4.1 percent drop, which is more favorable than the previous month’s indicator. Due to August, which provides two fewer working days this year, the raw data paint a much more unfavorable picture,” Péter Virovácz, senior analyst at ING Bank, evaluated the data.

In other words, overall, we still see a disappointing picture. This is confirmed by the fact that, compared to the average monthly performance of 2021, the volume of industrial output is currently 3.9 percent behind, and thus we have reached the lowest point in 2021

– added Virovácz, who also believes that the structural problems present in external demand and the moderate recovery expectations for next year still exist. In this regard, it is therefore difficult to base the desire fueled by the short-term recovery of Hungarian industry on the explosion of export demand.

Blog Forbes Daily: Join the Blog Forbes and get our best stories, exclusive reports and important analysis of the business daily, News, Travel, Health, Lifestyle and more.