Banks start charging huge deposit fees to meet lending targets and avoid taxes

FBR to consider taxing banks if private sector loans fall below 50% of deposits by year-end

Pakistani banks have started charging fees on large savings accounts to meet government’s Advance Deposit Ratio (ADR) requirements and avoid additional taxes.

The move is part of a broader strategy to boost private sector lending amid rising financial pressures. The first bank to do so was Bank Alfalah, which announced a monthly fee on November 15.

Latest News | Imran Khan Gets Bail

Other banks quickly followed suit, with Habib Bank Limited (HBL) and Bank of Punjab (BoP) announcing similar fees on November 18.

Pakistan’s largest lender by profits, Meezan Bank Ltd. 5% Monthly Fee Announced for Savings Accounts with Balances of More than Rs 1 Billion ($3.6 Million)

“Meezan Bank is entitled to levy a monthly fee of 5% on deposit accounts with a balance of PKR 1 billion or more (or its equivalent in foreign currency) on the last day of the month,” the bank said in a notice.

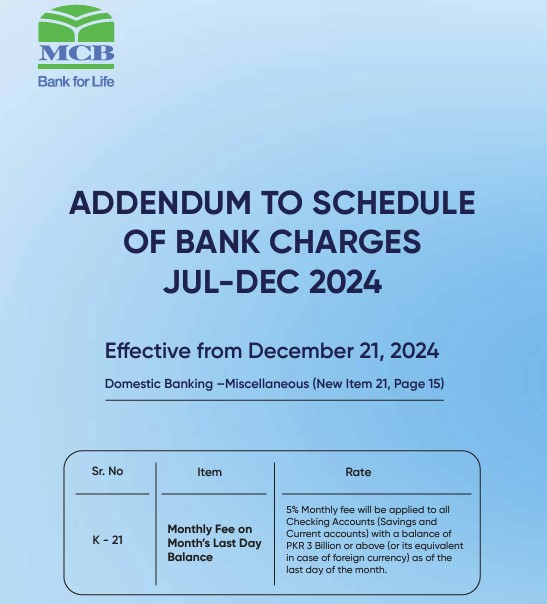

MCB Bank Limited said in the notice that it will levy a monthly fee of 5% on all types of deposit accounts (Savings and Current Accounts) with a balance of PKR 3 billion or more (or its equivalent in foreign currency) on the last day of the month.

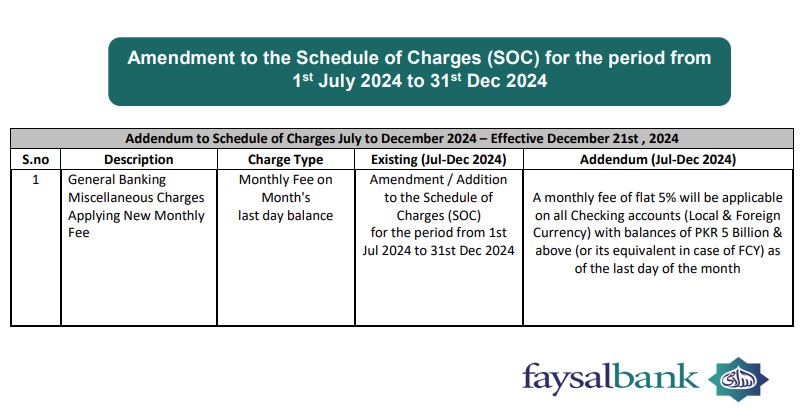

Faysal Bank said that it will levy a fixed monthly fee of 5% on all types of deposit accounts. This includes local and foreign currency accounts with a balance of PKR 5 billion or more (or its equivalent in foreign currency) at the end of the month.

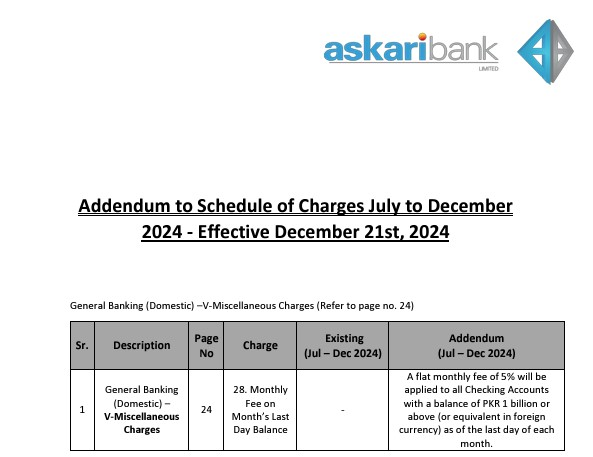

Askar Bank has announced that it will charge a fixed monthly fee of 5% on all types of deposit accounts with a balance of PKR 1 billion or more (or its equivalent in foreign currency) at the end of the month.

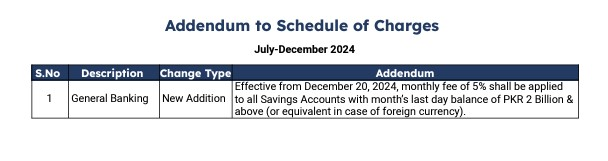

JS Bank has announced that it will charge a monthly fee of 5% from December 20, 2024, on all savings accounts with a balance of PKR 2,000 million or more (or its equivalent in foreign currency) at the end of each month.

Standard Chartered Bank Pakistan Ltd. has issued a similar announcement, joining rivals HBL and MCB that have implemented the measure earlier this week.

The Federal Board of Revenue (FBR) plans to penalize banks that fail to meet the 50% ADR requirement by the end of this year. While some banks have received interim relief from the courts, they argue that the levy hampers central bank supervision.

“Essentially, advances to deposits ratio (ADR) measures a bank’s lending activity relative to its deposits,” a report published by Profit said. The advance ratio refers to loans to the private sector (businesses or individuals) and deposits are the money that customers deposit with the bank through current accounts, savings accounts or fixed deposits. Banks pay interest on some deposits (such as savings or fixed deposits) and use this money to lend to the private sector or invest in government securities. Ideally, a healthy ADR reflects a bank that is actively lending to stimulate economic activity.”

As of October 25, the sector’s total loan-to-deposit ratio stood at 44%, with none of the 11 major banks reaching the 50% target, according to Karachi-based JS Global Capital Ltd.

“Banks are trying their best to lend while discouraging large deposits to avoid higher taxes,” said Suleman Rafiq Maniya, a Karachi-based asset manager. “Discouraging direct support is not feasible, so banks are using fees to limit inflows.”

The move is in line with Pakistan’s broader fiscal targets under the International Monetary Fund’s (IMF) $7 billion loan program, which calls for a record 40% increase in revenues. The banking sector is a key player in achieving these ambitious targets.

Also Read | Gold Rate in Pakistan today

Blog Forbes Daily: Join the Blog Forbes and get our best stories, exclusive reports and important analysis of the business daily, News, Travel, Health, Lifestyle and more.